The real estate sector is witnessing one of its strongest boom cycles in recent years. From

metro cities to emerging urban clusters, housing sales have surged, new launches are breaking

records, and developers are reporting some of the best quarterly numbers in a decade. On the

surface, the market looks unstoppable. But beneath the excitement lies a growing concern that’s

becoming harder to ignore: rising property prices are pulling homeownership further away from

young and first-time buyers.

Cities such as Mumbai, Bengaluru, Delhi-NCR, Pune, and Hyderabad are experiencing steep

price rises driven by high demand, premium launches, and increased construction costs. While

this is good news for developers and investors, it has created a significant affordability gap. The

average home price in major metros has outpaced income growth by a wide margin, making it

increasingly difficult for new buyers to enter the market without stretching finances to

uncomfortable levels.

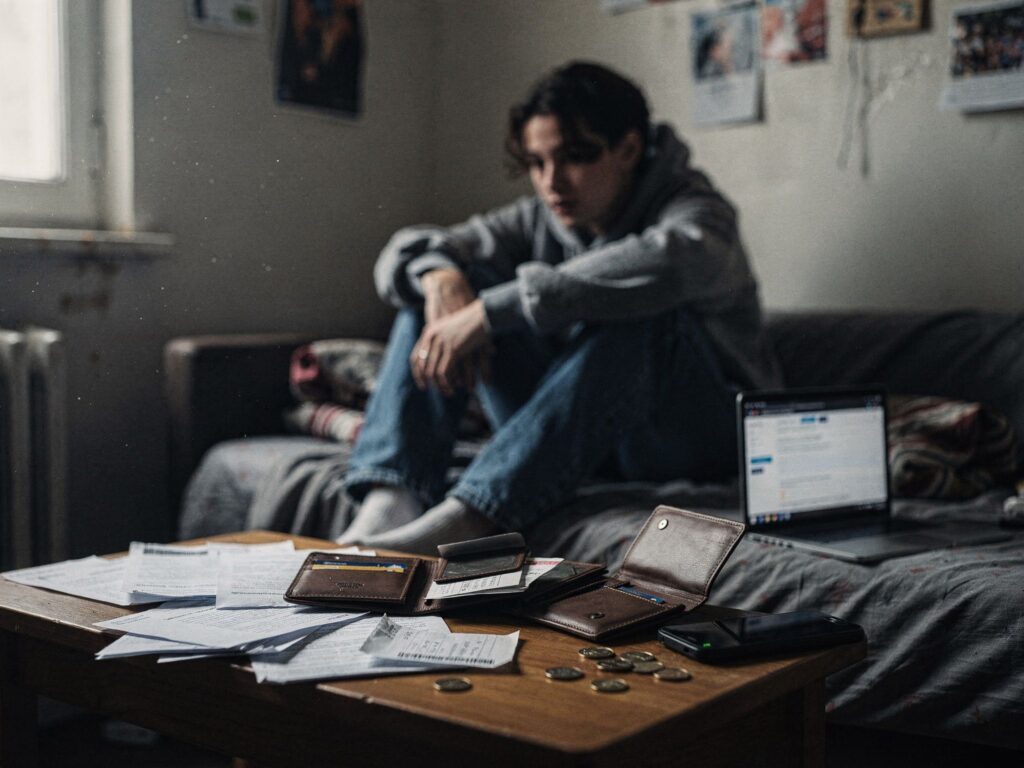

For many working professionals, owning a home is no longer a near-term goal but a long-term,

multi-year financial strategy. Heavy EMIs, rising interest rates, and large down-payment

requirements are turning homeownership into a distant milestone. As a result, many are

choosing to rent longer, delay purchases, or shift to peripheral areas where prices are still within

reach.

Industry experts believe this divide could reshape the future of housing demand. Developers

may need to rethink pricing, focus on mid-income segments, and offer more flexible payment

structures to keep the market inclusive. Meanwhile, the demand for rental housing and co-living

spaces is expected to grow as people prioritise flexibility over long-term financial commitments.

The boom is real, but so is the pressure. And unless affordability becomes part of the strategy,

the housing dream may slip further away for an entire generation of aspiring homeowners.